16+ Excise Tax Calculator Ma

The assessors of the municipality in which the. There is no excise tax due where the consideration stated is less than 10000.

Merchant Maverick

Web Calculating Excise Tax in Massachusetts 25 per 1000 of value or value x 0025 annual excise amount The excise rate is 25 per 1000 of your vehicles value.

. The tax rate on long-term gains from the sale or exchange of collectibles is 12 subject to a 50 deduction. The effective tax rate is 228 per 500 or fraction thereof of taxable value. Motor vehicle excise is taxed on the calendar year.

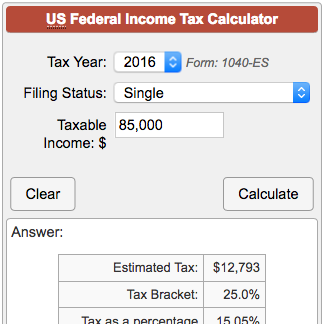

The income tax rate in Massachusetts is 500. It is charged for a full calendar year and billed by the community where the vehicle is usually garaged. Web Excise Tax Calculator.

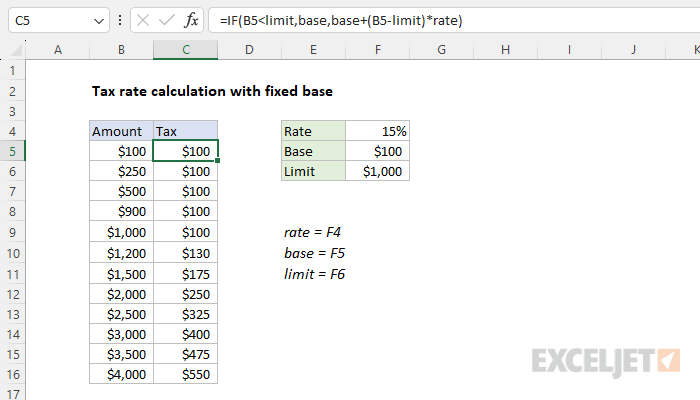

Web The formula used by the calculator is. Web State Income Tax Calculator Get detailed tax information for your state. Web The excise tax law MGL.

Web Tax Calculator PROPERTY DATABASE To calculate the change in your taxes from Fiscal 2023 to Fiscal 2024 go to the Town Property Database and look up your Fiscal 2023. The following is a summary of. Web Massachusetts has a fixed motor vehicle excise rate thats 25 per 1000 of the cars value.

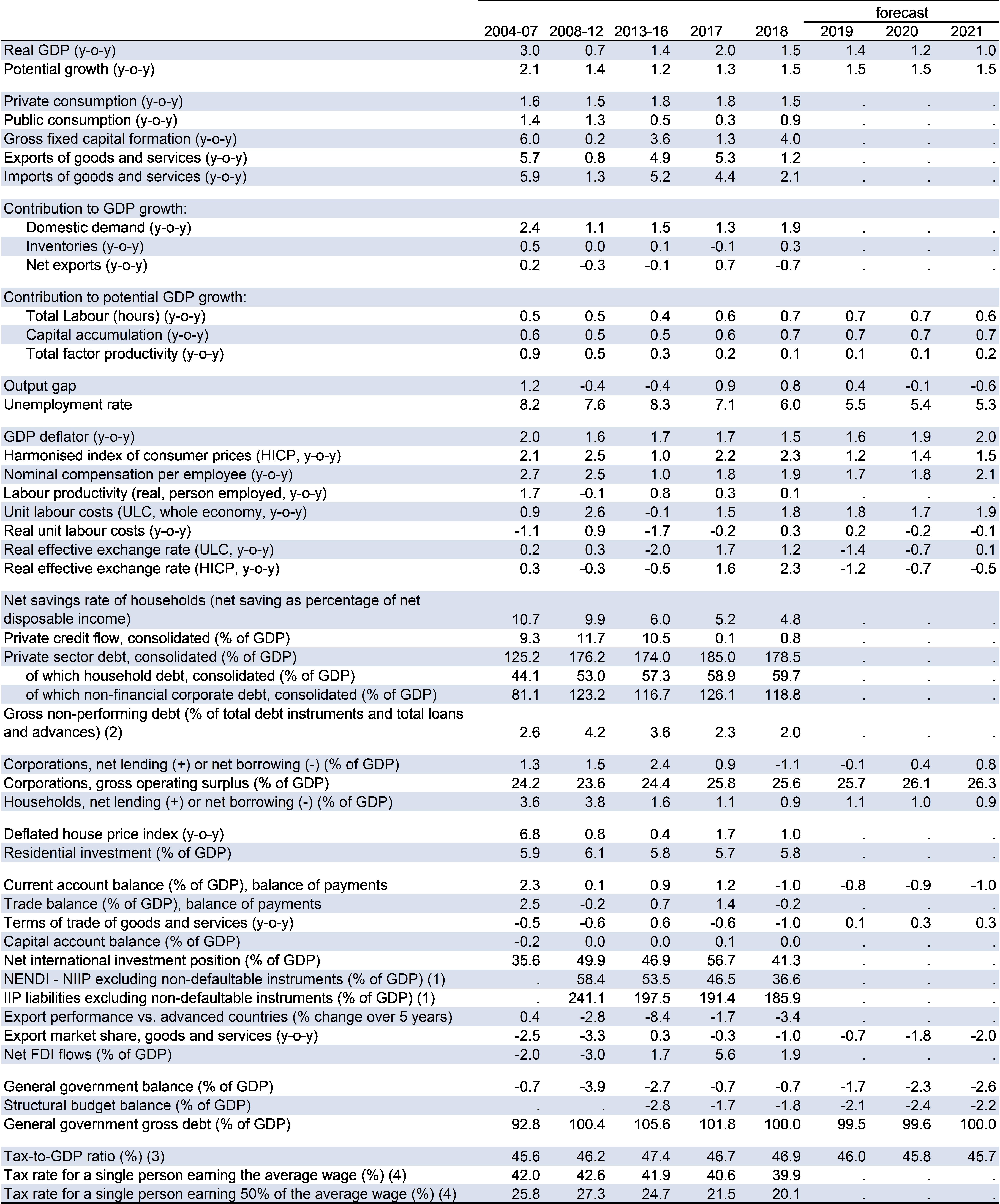

The Commonwealth of Massachusetts derives revenue from the sale of real estate through the sale of state tax stamps. Web Here you will find descriptions of major Massachusetts Personal Income Chapter 62 and Corporate Excise Chapter 63 tax law changes for tax year 2021. It is an assessment in lieu of a personal property tax.

Web The excise rate is 25 per 1000 of your vehicles value. It is charged for a full calendar year and billed by the community where the vehicle is usually garaged. Chapter 60A imposes an excise on the privilege of registering a motor vehicle or trailer in the Commonwealth.

Web Deed Excise Tax. Web Auto Excise Tax. Web Calculating Motor Vehicle Excise Taxes.

Once the value of the vehicle is determined an excise at the rate of 2500 per thousand is assessed. C60A s1 establishes its own formula for valuation for state tax purposes whereby only the manufacturers list price and the age of the motor vehicle are. Web Massachusetts Income Taxes.

The amount of the excise tax stamp. Massachusetts generally follows the Internal Revenue Code IRC as currently in effect for Massachusetts corporate excise tax purposes. Massachusetts Income Tax Calculator It may seem like filing your taxes should be easy since.

Web A 1075 excise tax is imposed on transfers of marijuana and marijuana products from a retailer. To find out the value of your car you will have to visit the Massgov. Web The excise rate is 25 per 1000 of your vehicles value.

Web Here you will find helpful resources to property and various excise taxes administered by the Massachusetts Department of Revenue DOR andor your. There is no state excise tax on medical marijuana sales. Web Calculating the Excise.

The excise due is calculated. Excise Tax Tax Rate Value of GoodsExcise Tax Tax Rate Value of Goods Where. That rate applies equally to all taxable income up to 1 million.

If your vehicle is. Motor Vehicle Excise - Chapter 60A. Web The tax rate on most classes of taxable income is 5.

Template Net

1

1

Scribd

Youtube

1

Mass Gov

1

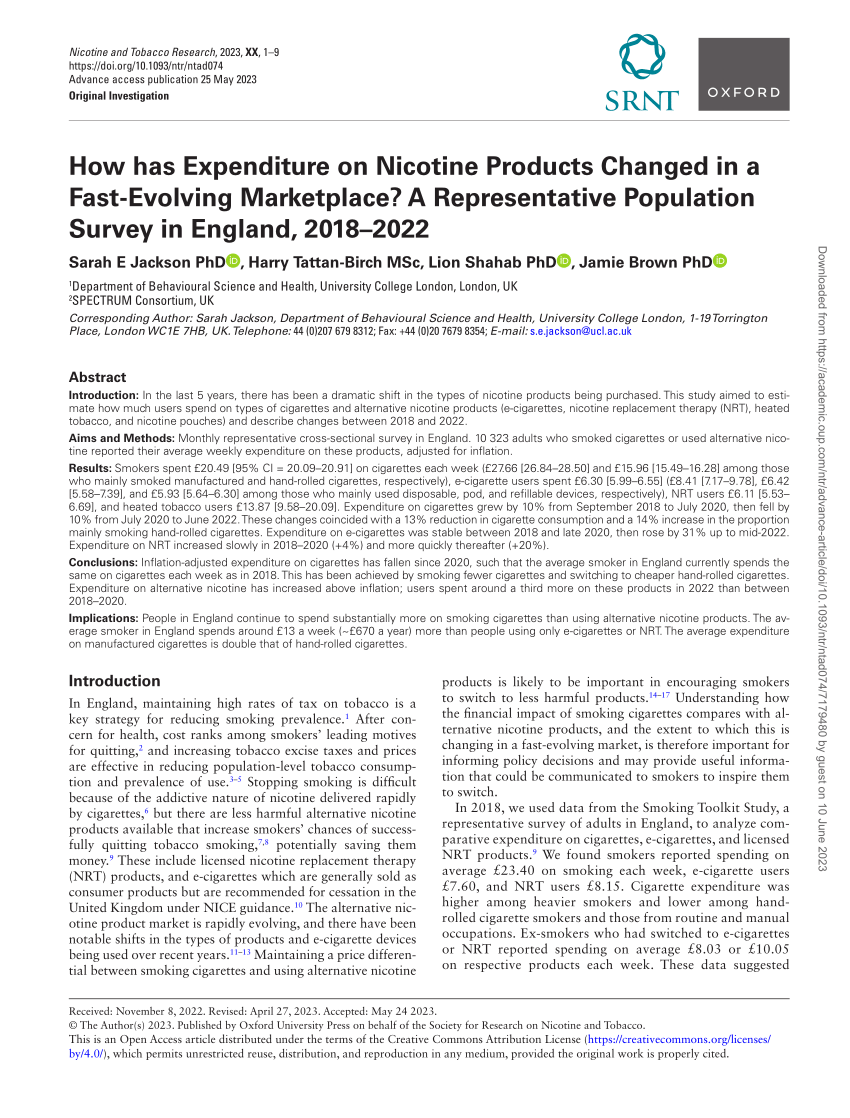

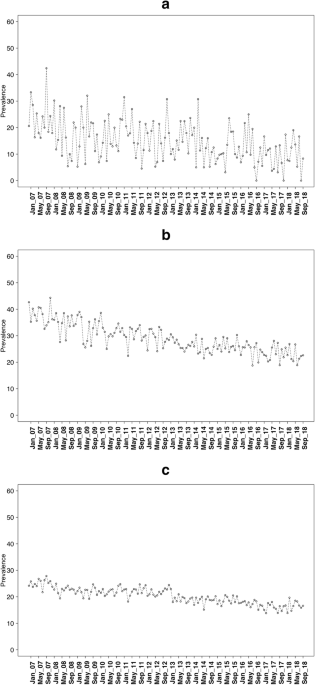

Bmc Medicine Biomed Central

Exceljet

Smartasset

Calculator Soup

Soft112

North Carolina Retail Merchants Association

Franklin County Registry Of Deeds

1

Https Www Google Com Search About This Image Img H4siaaaaaaaa Ms4 Js9p 1naodb28ycrzcfqx1 Cjrz1syav 64jgyaaaa Q Https Link Springer Com Content Pdf 10 1007 S10797 007 9035 Y Pdf Ctx Iv